Cash flow is the lifeblood of any business. No matter how profitable a company appears on paper, poor cash flow management can quickly lead to financial stress or even failure. Understanding where money comes from, where it goes, and how it moves through a business is essential for stability, growth, and long-term success.

Effective cash flow management allows businesses to stay prepared, make informed decisions, and navigate both opportunities and challenges with confidence.

What Cash Flow Management Really Means

Cash flow management is the process of tracking, analyzing, and optimizing the movement of money in and out of a business.

It focuses on:

- Monitoring incoming payments

- Managing outgoing expenses

- Ensuring sufficient liquidity at all times

The goal is not just to avoid running out of cash, but to use available funds strategically.

Why Profit Alone Is Not Enough

Many businesses assume that profitability guarantees financial health. In reality, profits do not always equal cash in hand.

Cash flow problems can arise when:

- Customers delay payments

- Inventory ties up cash

- Expenses occur before revenue is collected

A business can be profitable yet still struggle to pay bills if cash flow is poorly managed.

Cash Flow Supports Day-to-Day Operations

Consistent cash flow ensures that essential operations continue without disruption.

Strong cash flow management helps businesses:

- Pay employees on time

- Cover rent, utilities, and supplier costs

- Maintain inventory and services

- Avoid reliance on emergency borrowing

This operational stability builds trust with employees, suppliers, and partners.

Better Decision-Making and Planning

Clear visibility into cash flow allows business owners to make smarter decisions.

With accurate cash flow data, businesses can:

- Plan expansions confidently

- Invest in new equipment or staff

- Schedule major expenses strategically

- Avoid overextending financial resources

Cash flow insights reduce guesswork and support long-term planning.

Reducing Financial Stress and Risk

Unpredictable cash flow creates pressure and limits flexibility. Proper management reduces uncertainty and financial anxiety.

Key risk-reduction benefits include:

- Early identification of cash shortages

- Better preparation for slow seasons

- Reduced dependence on high-interest loans

- Stronger financial resilience during market changes

A healthy cash flow acts as a financial safety net.

Cash Flow Enables Sustainable Growth

Growth often requires upfront spending, whether for marketing, hiring, or infrastructure. Without proper cash flow management, growth can become risky.

Cash flow supports growth by:

- Funding expansion without excessive debt

- Allowing gradual, controlled scaling

- Supporting innovation and new initiatives

Sustainable growth depends on timing investments with available cash.

Managing Receivables and Payables Effectively

How and when money is collected and paid plays a major role in cash flow health.

Effective practices include:

- Setting clear payment terms

- Following up on overdue invoices

- Negotiating favorable supplier terms

- Spreading large expenses when possible

These actions help maintain balance between inflows and outflows.

Cash Flow Is Crucial for Small Businesses

Small businesses are especially vulnerable to cash flow disruptions due to limited financial buffers.

For small businesses, cash flow management:

- Improves survival during slow periods

- Strengthens relationships with lenders

- Builds credibility with investors

- Supports long-term sustainability

Even modest improvements can have a significant impact.

Conclusion

Cash flow management is not just a financial task—it is a strategic discipline. By actively monitoring cash movement, planning ahead, and making informed decisions, businesses can remain stable, reduce risk, and unlock growth opportunities. Strong cash flow management turns financial uncertainty into control, making it one of the most important foundations of business success.

Frequently Asked Questions (FAQs)

1. What is the difference between cash flow and profit?

Profit reflects earnings after expenses, while cash flow shows the actual movement of money in and out of a business.

2. How often should cash flow be reviewed?

Ideally, cash flow should be reviewed weekly or monthly to identify trends and potential issues early.

3. Can cash flow problems affect profitable businesses?

Yes. Delayed payments or high upfront costs can cause cash shortages even in profitable companies.

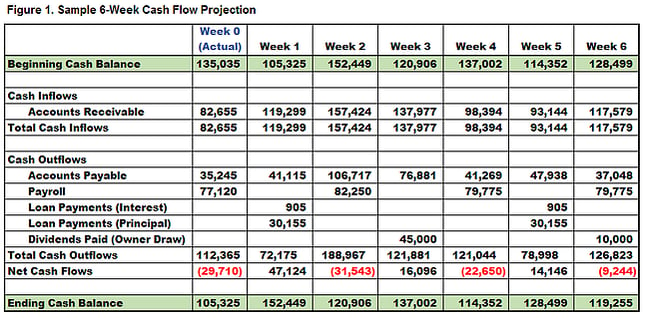

4. What is cash flow forecasting?

It is the process of estimating future cash inflows and outflows to anticipate financial needs.

5. How can businesses improve cash flow quickly?

Speeding up collections, reducing unnecessary expenses, and renegotiating payment terms can help.

6. Is cash flow management only important for large companies?

No. It is critical for businesses of all sizes, especially small and growing ones.

7. Can good cash flow management reduce the need for loans?

Yes. Maintaining healthy cash reserves often reduces reliance on external financing.